Irs Business Tax Extension 2025. Instead of filing by april 15, a tax extension moves your small business tax return due date six months into the future. Citizens and permanent residents who work in the united states need to file a tax return if they make more than a certain amount for the year.

Submit your federal tax extension request to the irs. The extension gives you six extra months —until october.

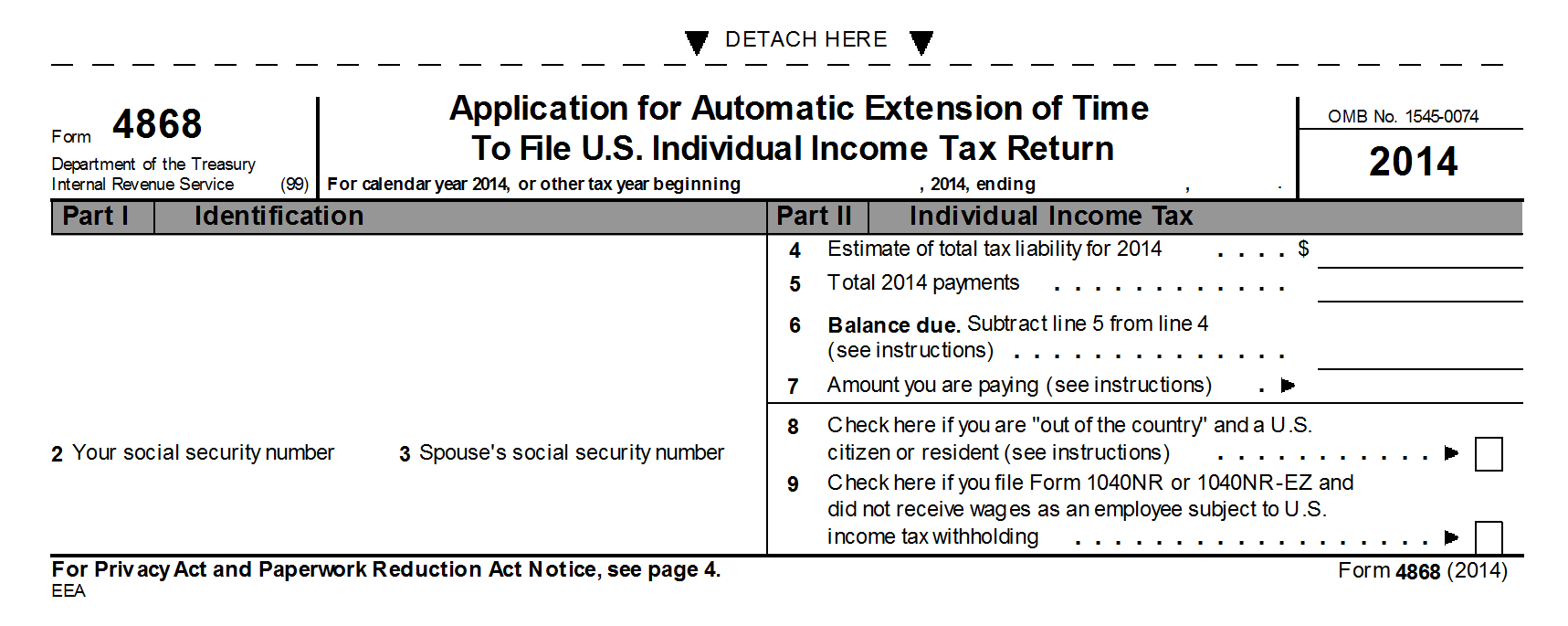

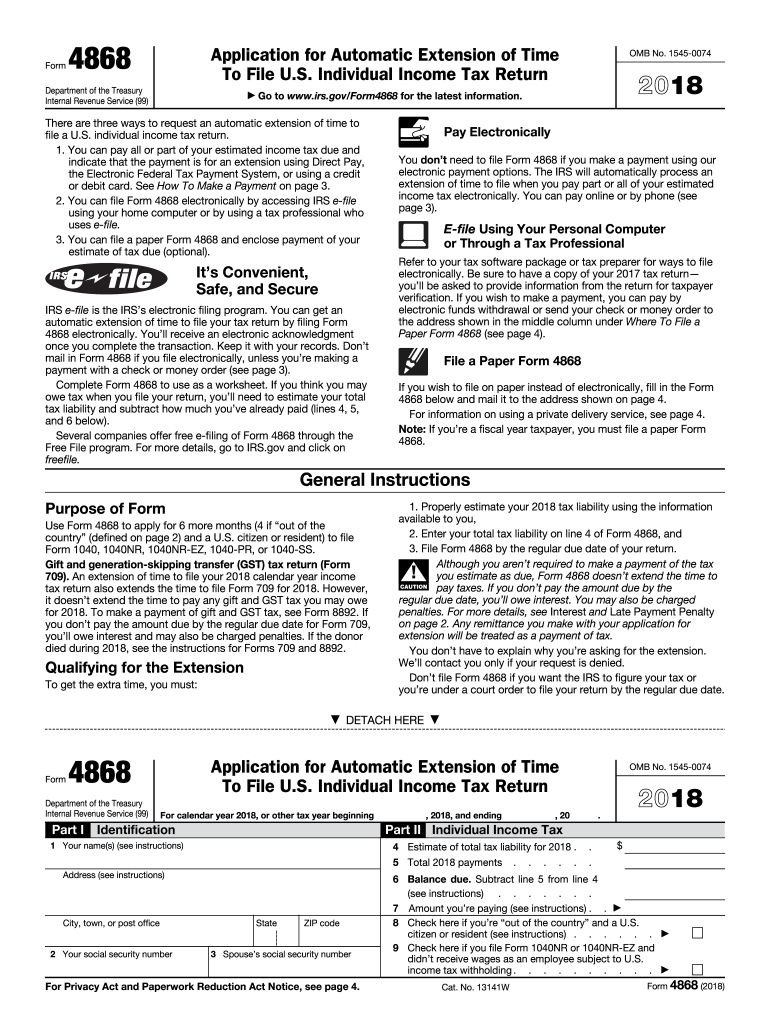

Irs Tax Extension 2025 Van Kameko, Filing this form gives you until october 15 to file a return.

2025 Irs Extension Form Peggi Tomasine, October business tax deadlines for 2025 tuesday, october 15, 2025.

Irs Extension Filing Deadline 2025 Robby Christie, An easy way to get the extra time is through irs free file on irs.gov.

Irs Extension Deadline 2025 Darya Emelyne, Download the tax forms that correspond to your business type.

:max_bytes(150000):strip_icc()/Screenshot2023-03-02at11.05.35AM-1f84898730d248759e61f6ad2e1cb4fe.png)

IRS How to File a Tax Extension Step by Step YouTube, Download the tax forms that correspond to your business type.

Irs Efile Extension 2025 Libbi Othella, Follow these four steps to getting an automatic extension on.

How Long Is Irs Tax Extension 2025 California Bekki Carolin, When are 2025 tax extensions due?

Thanksgiving Prayer. A thanksgiving prayer (2019 bcp, pg. We thank you for the gift of life: A prayer for a[...]

Styx On Tour 2025. The renegades & juke box heroes tour kicks off june. Come on in and see what’s[...]

2025 Jeep Grand Cherokee Ground Clearance. So, we would request you to wait for official. Discover how the 2025 jeep®[...]